FEATURES

Quant Strategy Marketplace

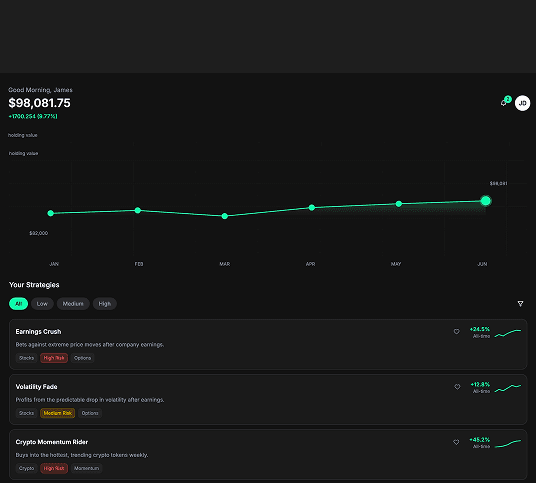

Invest directly in tokenized quant strategies with live NAV and real-time performance tracking.

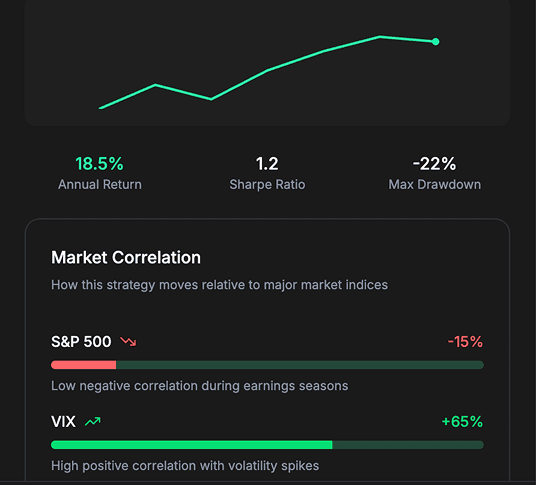

Transparent Metrics

Every algorithm comes with Sharpe ratio, drawdown, volatility profile, and sector filters — no tricks.

Instant Liquidity

Buy and sell strategy-linked tokens anytime. No lockups. No minimums.

DEVELOPERS

MONETIZE YOUR ALGORITHMS

Turn your strategies into tokenized products and earn payouts tied directly to performance. Build on our infrastructure with no setup costs, no brokerage hurdles, and full transparency.

FAQ

Welcome to the AGORI Marketplace, a tokenized investment platform that provides direct access to quantitative trading strategies. By utilizing blockchain and smart contract technology, AGORI creates a custom secondary market domain where any retail Investors can allocate into hedge-fund-grade algorithms. No minimums, no lockups, and full transparency..

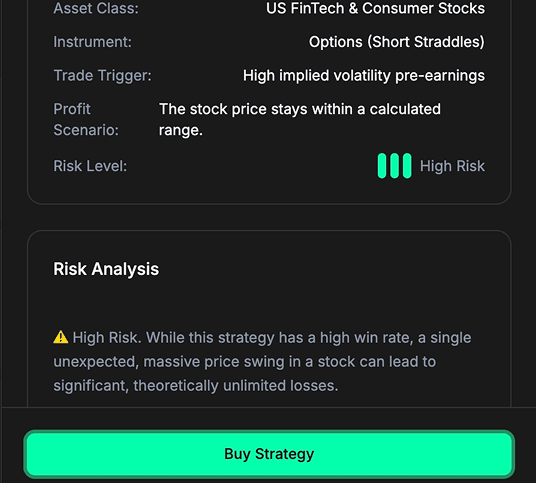

AGORI Marketplace democratizes access to quantitative investing by offering strategies that were once reserved for institutions. Each strategy is tokenized, updated daily with NAV (Net Asset Value), and explained clearly with key metrics such as Sharpe ratio, drawdown, correlation to markets, and sector exposure. Unlike traditional funds, AGORI provides instant liquidity, real-time transparency, and an intuitive guided allocation process so you always know how your capital is being managed.

AGORI features a curated library of tokenized quant strategies designed for different risk and return profiles. Investors can view live performance metrics, historical results, and NAV updates for each strategy. The platform enables instant buy and sell of strategy-linked tokens with clear and rational fee logic. In addition, AGORI supports weekly algorithm submissions, allowing new strategies from private external developers to be onboarded continuously, with payouts tied directly to performance.

AGORI gives you direct access to quant strategies that deliver transparency, liquidity, and institutional-grade performance. You’re incentivized by the ability to allocate flexibly, withdraw at any time, and track your portfolio in real time without the opacity and fees of traditional funds. From a developer standpoint, AGORI provides one of the strongest incentive structures among quant-competition platforms: paying $0.05 for every $1 of NAV appreciation straight to developers.

All strategies on AGORI are run through our proprietary infrastructure with strict risk management controls and constant drawdown monitoring. Tokens are backed by live capital deployed into the underlying algorithms, and performance is calculated and updated in real time. Our blockchain interface adds an additional layer of security: strategies are encrypted on-chain so that results can be verified, but the underlying code cannot be accessed or copied, including by the AGORI team. This protects both investor capital and developer intellectual property. As with any investment, risk cannot be removed, but AGORI is structured to make those risks as transparent and controlled as possible.

Yes. Unlike hedge funds or private investment vehicles, AGORI tokens are liquid by design. You can buy or sell your strategy-linked tokens at any time. NAV updates daily, ensuring that you always know the value of your holdings at the point of redemption.